Debt is an important tool in a farmer’s financial toolbox.

It allows farmers to purchase assets needed to expand their operations while preserving their annual cash-flows. As farmers pay down debt, they build more equity that can be collateralized to access more debt and fuel more growth.

Yet many farmers struggle to access debt when they need it most – whether it’s to purchase must-have land or make a critical investment – because they can’t pull together a down payment, even if they have strong cash flowing operations.

That’s why more farmers are turning to equity capital to access the debt they need.

Here’s a quick primer on how debt and equity can work together to grow your business, how they differ, and when they make the most sense:

Equity capital helps you to access more debt.

Accessing debt financing often requires a down-payment, in many cases 40% of the loan’s value. Instead of spending years saving, equity financing allows you to come up with a down-payment quickly and take advantage of those opportunities to expand. It also allows you to be more strategic in how you employ debt.

Equity capital preserves your cash flows

Unlike debt, equity financing doesn’t come with interest or principal payments. The cost of equity typically takes the form of an annual premium, which is a rent-like payment. This premium is a percentage of the equity investment amount.

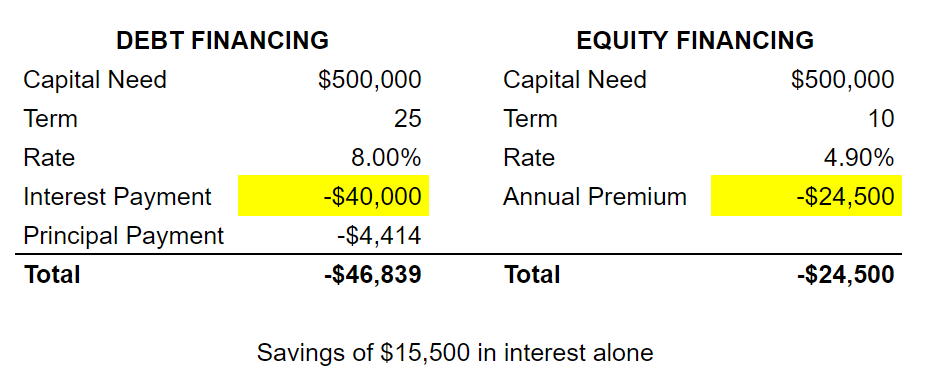

Annual premiums can range anywhere from 3% – 6% of the investment compared to debt payments with interest rates as high as 9%. The differences in serving debt vs. equity can be striking. Look at the example to access $500K in capital:

Equity requires limited collateral

With debt, you’re often required to pledge and collateralize multiple fields.

Equity capital is tied to a single field. Even if something catastrophic happens, the investor only gets exposure to the field that was pledged for equity investment. The investor has no ties or rights to the rest of your farm operation.

Equity shares the risk of changing market conditions

With debt, you hold all of the risk regardless of market conditions. If corn goes from $6 to $2/bushel, you make the same payment year over year.

With equity, the risk is symmetric. Your annual premiums are tied to the value of the land. As farmland depreciates, so does your annual premium, thereby preserving your working capital. If you can’t make an annual premium payment, you can often pay with additional equity.

Equity diversifies your access to capital

The reality is, most farmers have access to one or two bankers. If there’s a downturn and your bank(s) close the taps on debt, or interest rates make it cost-prohibitive, where are you going to access capital?

Equity financing offers another option and the flexibility to weather changing trends in the economy. It positions you with the capital you need, when you need it most, to seize that next must-have opportunity (regardless of when that opportunity may arise).

Access more capital with Fractal, a long-term investment partner that helps you tap into your equity while keeping you in control. Learn more

Note this is not investment advice. The information contained should be used for informational purposes.

Authors:

Harrison Rogers is the Marketing Lead at Fractal Agriculture, Inc.

Steve Conaway is a real estate appraiser and analyst, and farmer of corn, beans, wheat, and grain sorghum in north Kansas

LEARN HOW TO UNLOCK YOUR EQUITY

"*" indicates required fields

We hold your data in high regard. By submitting this form, you are consenting to the use of this information in compliance with our Privacy Policy.