Why? Because working capital is your most valuable asset.

2022 was arguably the most profitable year in history for the row crop farmer in America, surpassing earnings from the almighty 2013. Historic cash positions have been created on the farm balance sheet, making it tempting to avoid financing purchases at all. Many crops were planted and harvested without having to borrow any funds.

Now, 80 acres bordering your farm are for sale. You could pay for it with cash to avoid today’s high interest rates, but should you?

Here are some important things to keep in mind.

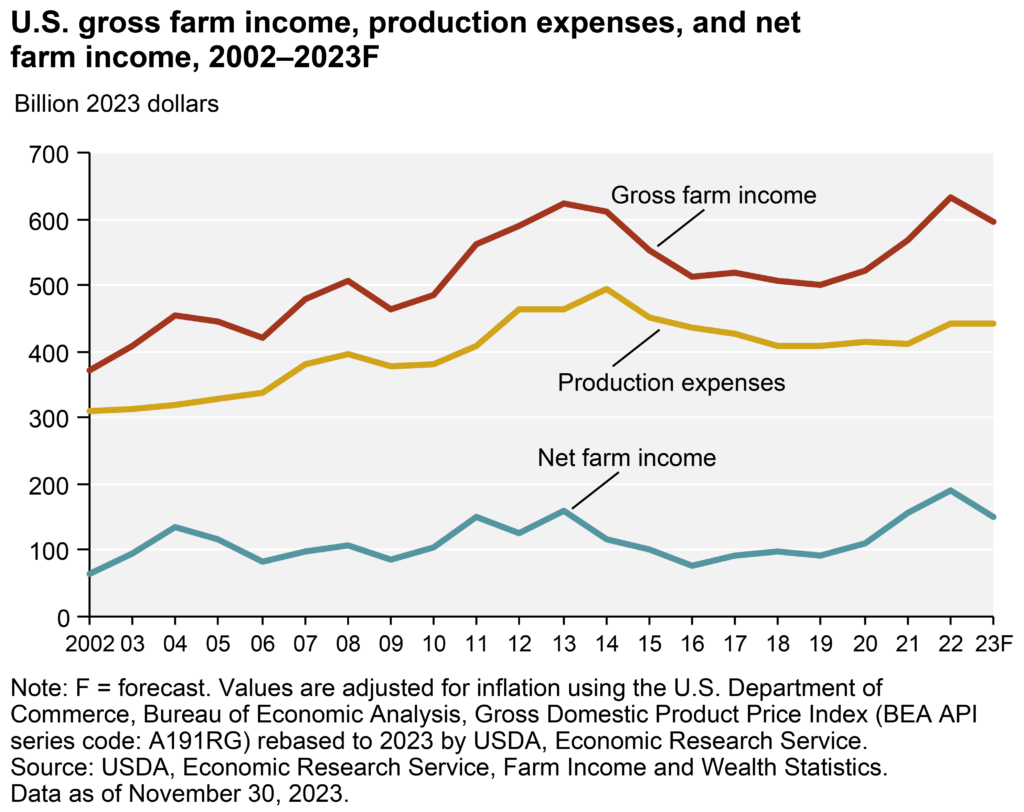

What did we see after 2013?

Production costs went up, while farm income went down.

If the ag cycle repeats itself, farming is about to get much more expensive. Balance sheet deterioration was very common from 2014 to 2019. Consider commodity prices alone:

2014 – 250,000 bushel corn @ $6.50/bu = $1,625,000

2019 – 250,000 bushel corn @ $3.25/bu = $812,500

Working capital was often cut in half before factoring in the higher input costs needed to grow the same number of bushels.

The takeaway? The working capital you have today possibly won’t be there this time next year.

Working capital is your short-term, risk-bearing ability. Having a strong working capital helps you survive downturns in the market. Working capital gives you options to buy and buy again if you still have cash.

Top 4 reasons to finance new ground instead of paying cash

Be Ready for the Generational Shift

The baby boomer generation is the largest land-holding generation alive. As margins tighten, farming can lose its enjoyment. Many boomers may choose to ‘hang it up’ and retire. This will lead to a huge transfer of land that younger operators need to be prepared for. Keep your powder dry to give yourself the best chance of winning these land purchases when they become available.

Avoid Hitting Your Operating Note

Operating debt is the most expensive farm debt available. You could spend $800,000 cash to buy a farm, then need another $800,000 on your operating note to plant the crop. These interest rate differences could be as high as 3%. That might be $24,000 in extra interest paid because you chose to put the new farm purchase on your operating note instead of using long-term financing with cheaper interest.

Take Advantage of Favorable Terms

With strong working capital, now might be the easiest time to get financing. If we do see higher input costs and lower commodity prices leading to a downturn in the ag cycle, your golden window to get the best financing terms may be right now. In 2019, it was not uncommon for lenders to “clean up” their ag portfolio and move on from high-risk operations. This left farmers scrambling to find a new lender who required higher interest rates and more collateral to secure their position, possibly even taking a second lien.

Keep Peace of Mind

Is the Fed going to raise interest rates again? Will the crop conditions report show record yields? Will the WASDE increase ending stocks? Why are exports down? Many of these external factors matter a little less when you preserve your cash. By keeping cash in your pocket instead of tying it up in real estate, you help protect your operation for the next generation.

Bonus

Low interest rates the past three years have allowed for almost all existing land notes to be repriced at or below 4%, reducing payments due. Extra debt paydown has also improved many operations’ cash flows. These two scenarios can create extra capacity in your operation to service the new debt and protect your working capital.

Author: Grant Wiese

Grant Wiese is a former ag loan underwriter and current ag lender who also farms corn and soybeans in Nebraska.

In his weekly newsletter, Grant shares insights on how to set goals and achieve them through financial literacy. We’re excited to share them with our subscribers. For more great content, sign up for Grant’s weekly newsletter at www.farm640.com and follow Grant on www.X.com @gwiesefarms

LEARN HOW TO UNLOCK YOUR EQUITY

"*" indicates required fields

We hold your data in high regard. By submitting this form, you are consenting to the use of this information in compliance with our Privacy Policy.