The market for US farmland has changed dramatically over the last two years. Gone are the days of steady appreciation and low interest rates. Farmland values are up 40% while interest rates for land loans have increased by 4% since the summer of 2021.

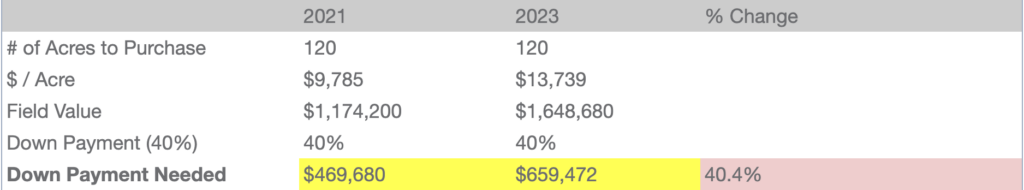

The end result: it’s never been more capital intensive to purchase land, especially if you’re a farmer. The numbers are striking. Let’s compare the capital needed to purchase 120 acres today vs. the same time in 2021.

The investable capital needed to access debt increased by 40%

High quality farmland in Indiana is up 40% since the fall of 2021 according to Purdue University. To buy the same field today, farmers need an additional $200,000 just to access the debt needed to close a deal.

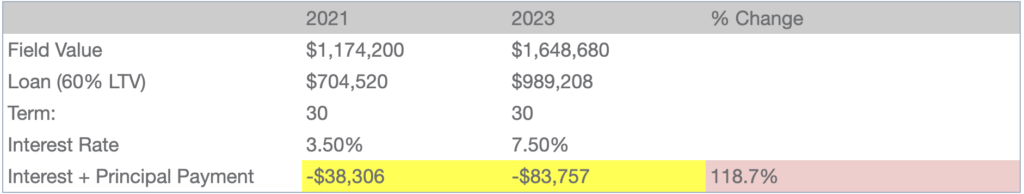

The cash needed to service debt on new land loans more than doubled

The Fed’s interest rate increases pushed land loan interest rates to as much as 8%, thereby increasing the costs of servicing debt. Farmers need to budget an additional $50,000 in working capital to pick-up another 120 acres.

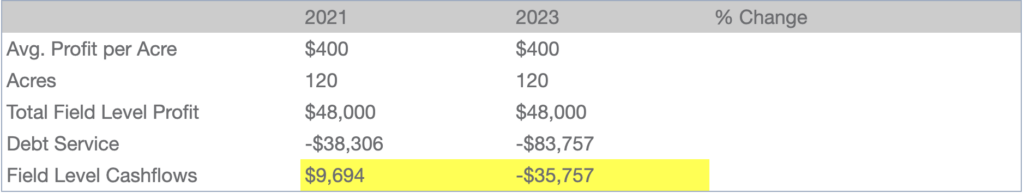

Increased debt service costs mean it’s harder for fields to cash-flow

The profit generated from a field can no longer cover its mortgage at 60% LTV. This requires farmers to either collateralize other fields to cover these payments or increase the size of their down payment to reduce their debt service. For many new farmers, they are placed in a Catch-22 of options to access the debt they need.

Farmers are increasingly turning to farmland equity partners

Many investment groups exited or at least slowed down buying farms at these elevated prices. Cash rental rates did not rise as fast as the land values and investor return rates dwindled. Due to higher interest rates, smaller investors and potential 1031 buyers have other options to make higher interest rates resulting in fewer investor buyers.

What other options exist for farmers to access capital to make the purchase described above? Companies like Fractal offer alternatives to traditional debt financing that farmers may find appealing for their specific situation.

Author: Howard Halderman

F. Howard Halderman is the president of Halderman Farm Management Service (HFMS) and vice president of Halderman Real Estate Services (HRES). He is responsible and accountable for overseeing the day to day operations of HFMS and developing the strategic direction of firm. HFMS manages $1 billion in assets and more than 650 farms in 18 U.S. states.

LEARN HOW TO UNLOCK YOUR EQUITY

"*" indicates required fields

We hold your data in high regard. By submitting this form, you are consenting to the use of this information in compliance with our Privacy Policy.