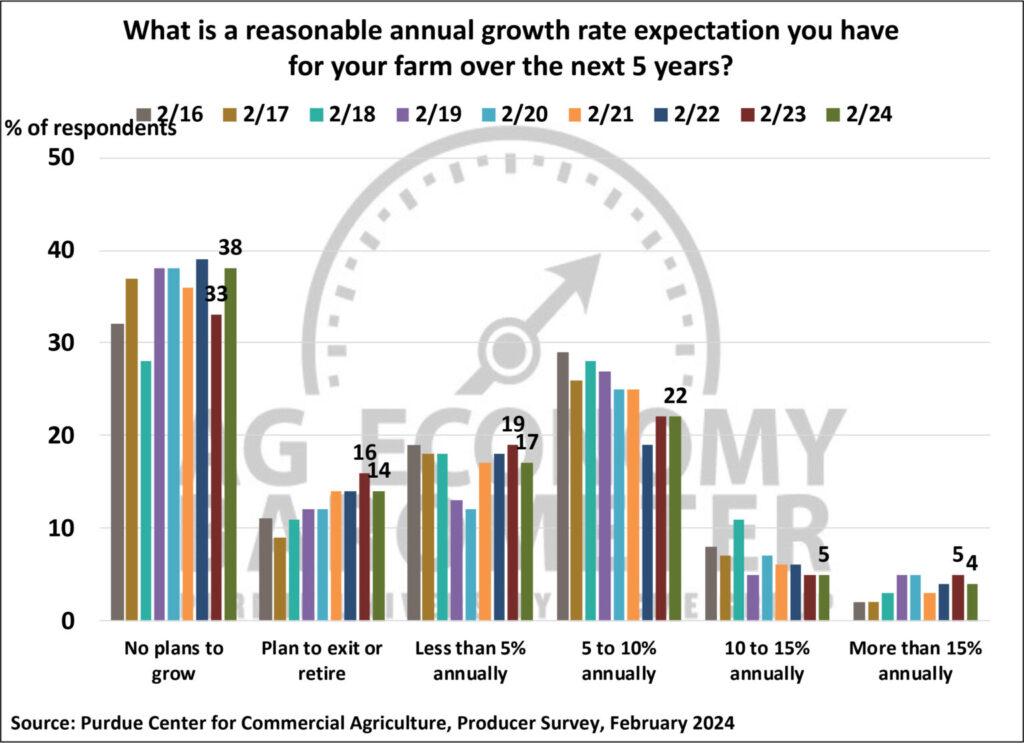

To double the size of your farm operation in 10 years, you’ll need to grow your business by ~7% per year. With many farmers worried about covering the cost of their crop, it’s not surprising that only 3 in 10 farmers still expect to grow +5% annually over the next 5 years.

Most likely, it’s because these farmers understand their balance sheet, are focused on the right opportunities, and are planning ahead.

To see where you stand, here’s what your peers have to say (as captured in Purdue’s Ag Economy Barometer*):

Over 50% of farmers don’t expect to grow in the next 5 years

In March 2024, Purdue reported that 38% of farmers see no plans to grow, while 14% expect to exit their operation over the next five years.

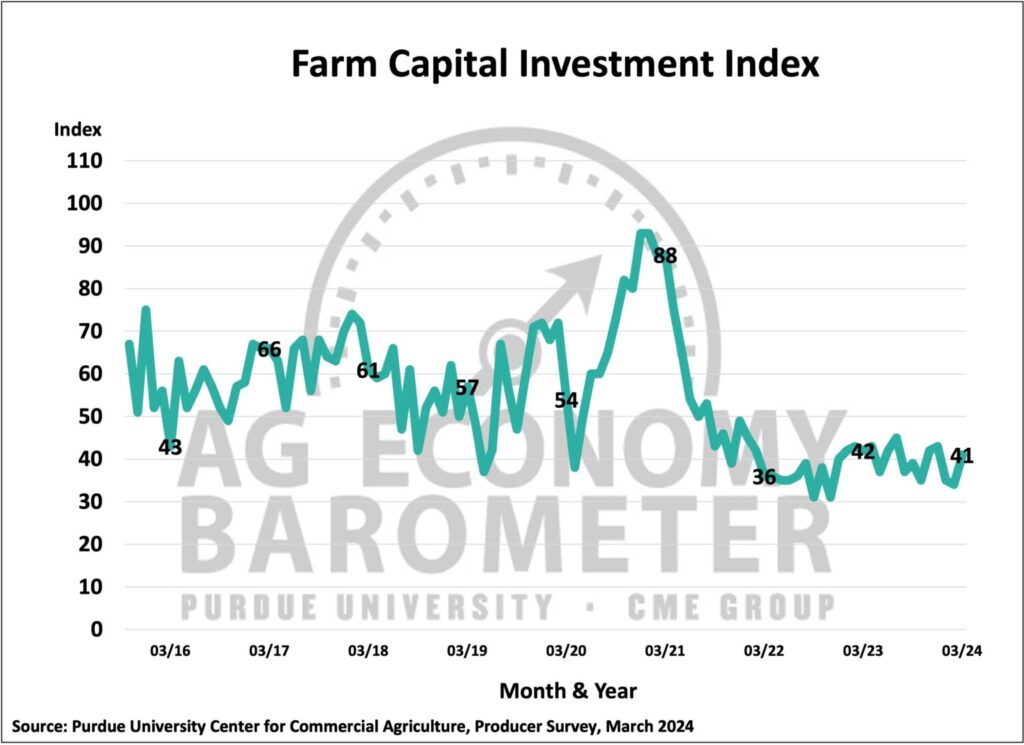

Profitability is preventing farmers from making capital investments

Purdue’s Farm Capital Investment Index measures current farmer confidence in making large investments back into their operation. As of March, farmer confidence remains near an all-time low, with the number of farmers citing “uncertainty about farm profitability” tripling since last October.

farmers expect competition from outside investors

According to a March 14, 2024 release from Farmers National, land sales volume was down in Q1 2024, with commodity prices having the biggest impact on land values. “When profit potential is cut in half, the result typically ends up being a retraction in buying power.”

In March, 38% of farmers surveyed by Purdue said they expect short-term farmland values to rise in 2024, with inflation and strong cash flows driving value. Over half of those farmers cited non-farm investor demand as the number one reason for their bullish outlook.

How do you keep growing in a down cycle?

With only 50% of farmers expecting to grow in the next 5 years, those farmers who can figure out a way to cash flow more deals while maintaining a strong financial position will have the advantage. So how do you position yourself for success?

- Define a good opportunity: Understand what makes a good land deal and when to chase it.

- Build a capital plan: Tactically work with your lender to understand your financial position and the best opportunities for expansion.

- Preserve liquidity: Seek out ways to preserve working capital, so you have cash on hand for your next deal.

- Consider farmland equity capital: Farmers are increasingly turning to investor partners to access the capital they need and better compete for land.

By tapping into the equity you have in your existing operation, you can access the capital you need – when you need it most – while preserving your working capital.

Learn how you can cash flow more deals with Fractal, a long-term investment partner that helps you tap into your equity while keeping you in control.

*Every month, Purdue University’s Ag Economy Barometer, explores farmer attitudes on the U.S. economy by interviewing 400 producers with annual market production values at or above $500,000 (stratified to ensure they correspond with the USDA’s Census of Agriculture).

Note this is not investment advice. The information contained should be used for informational purposes.

Author:

Harrison Rogers is the Marketing Lead at Fractal Agriculture, Inc.

LEARN HOW TO UNLOCK YOUR EQUITY

"*" indicates required fields

We hold your data in high regard. By submitting this form, you are consenting to the use of this information in compliance with our Privacy Policy.